BIRMINGHAM – The U.S. Attorney’s Office has charged the former executive director of the Jefferson County Committee for Economic Opportunity and her daughter in connection with the theft of close to $500,000 from the nonprofit organization, announced U.S. Attorney Joyce White Vance and FBI Special Agent in Charge Richard D. Schwein Jr.

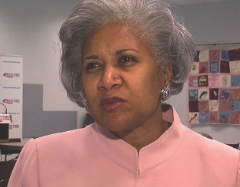

In separate informations filed in U.S. District Court, federal prosecutors charged Ruth Gayle Cunningham, 63, with theft from a government program that had received more than $10,000 in federal funding or assistance, and charged her daughter, Kelli E. Cauldfield, 31, with conspiracy in the scheme to defraud JCCEO.

Cunningham was executive director of JCCEO for more than 20 years before resigning the job in March. The organization employed Caulfield from May 2009 to January 2013. JCCEO is a community action agency that administers programs, including Head Start, for low-income and disadvantaged residents.

“JCCEO is an organization with 50 years of history helping some of our poorest citizens become part of the American Dream with education and assistance funded in part by federal taxpayer dollars,” Vance said. “Cunningham abused the trust and discretion she was given to use this money wisely to benefit those in our community who are struggling. She used the agency’s government funds as a personal piggy bank so that she and her daughter could line their pockets with hundreds of thousands of dollars intended to lift others out of poverty,” Vance said. “As a community, we have to demand better from those who are charged with using public money for the benefit of all. I encourage anyone aware of this type of abuse of the public trust to contact the U.S. Attorney Office or the FBI.”

“Serving the public is a privilege, not an opportunity for unjust personal enrichment,” Schwein said. “Those who are entrusted to administer public programs, such as Ms. Cunningham, are expected to serve with integrity and honor. Greed and self-interest have no place in service to the community, and the FBI will continue to root out public corruption wherever we find it and at whatever level we find it,” he said.

Cunningham and her daughter, both of Birmingham, have signed agreements with the government to plead guilty to the charges against them. Jointly, Cunningham and Caulfield are responsible for repaying $492,195 to JCCEO, according to their plea agreements. Cunningham agrees to pay that full amount to JCCEO. Caulfield’s plea agreement cites her responsibility to repay $253,499 to JCCEO.

Cunningham acknowledges in her plea agreement that, between March 2009 and April 2010, she used JCCEO funds to make monthly mortgage payments on at least three residential properties she owned, and at least five residential properties her daughter owned, in Jefferson and Shelby counties. Cunningham also used JCCEO funds to pay property taxes on one of those properties, a house in Chelsea that she bought in 2007 with a mortgage loan of more than $1 million, according to court records.

Cunningham also paid $293,413 in JCCEO funds to companies owned by her daughter, and to other contractors, for claimed repairs or renovations to the women’s properties, according to their plea agreements.

As part of Caulfield’s conspiracy, she acknowledges in her plea agreement that she created invoices citing repair or improvement work on the private properties and gave them to her mother, who submitted the invoices and corresponding check requests to the JCCEO finance director.

As executive director of JCCEO, Cunningham had check-signing authority up to $5,000. All of the invoices Caulfield prepared for her mother to submit for payment by JCCEO were below $5,000 and, therefore, required no second signature from a JCCEO board member on the agency’s checks.

The maximum penalty for theft from a federally funded program is 10 years in prison and a $250,000 fine. The maximum penalty for conspiracy to defraud a federally funded program is five years in prison and a $250,000 fine.

The FBI discovered the fraud at JCCEO while it was investigating allegations of a mortgage fraud scheme. That investigation led to federal prosecutors’ charges against Cunningham and Caulfield, as well as to charges of conspiracy to defraud federally insured financial institutions against a real estate investor now living in Atlanta, and a Hoover mortgage broker. Cunningham and Caulfield bought most of the properties that later became part of their scheme to defraud JCCEO from the Atlanta investor.

The federal charges and associated plea agreements in all four cases were unsealed Friday in federal court in Birmingham.

The investor, the Rev. Robert Paul Hollman, 48, formerly of Dothan, and mortgage broker Brad A. Bozeman, 34, of Hoover, are charged with conspiracy to defraud a federally insured financial institution by either making or transmitting false statements and reports intended to influence a financial institution in connection with the sale of residential properties.

Hollman agrees to pay $393,440 in restitution to banks affected by his scheme and Bozeman agrees to pay restitution of $41,460.

According to Hollman’s and Bozeman’s plea agreements, their mortgage fraud conspiracy took place as follows:

Hollman bought multiple residential properties in Jefferson and Shelby counties and, beginning about 2007, solicited people to buy the properties from him. He would

agree, in advance of closing on the sales, to pay all or a portion of the down payments on the property and, afterward, to pay the monthly mortgage payments until the

properties resold. Once Hollman had an agreement with a purchaser, or “borrower,” he referred them to Bozeman to arrange a mortgage loan.

Hollman profited from the transactions because his debt on the properties was satisfied at closing and, in most of the transactions, he also received a cash payment from

the sales. After a period of time, he would stop providing the borrowers money for the monthly mortgage payments and most of the properties ended up in foreclosure.

Hollman made false statements on mortgage documents by failing to disclose that he, not the borrower, was making the down payment or part of the down payment on

the property. Bozeman made false statements on loan applications by including false income or not revealing all debts and liabilities of the purchasers, and transmitting

that information as true and accurate.

The maximum sentence for conspiracy to defraud a federally insured financial institution is five years in prison and a $250,000 fine.

The FBI investigated the cases, which Assistant U.S. Attorney Robin Beardsley Mark is prosecuting.

JCCEO Response

BIRMINGHAM – In response to information released today by the United States Attorney’s Office, the Jefferson County Committee for Economic Opportunity is releasing the following statements:

From Board Chair Rev. T. L. Lewis:

Since learning of the investigation on this matter in March of this year, the JCCEO Board of Directors has worked closely with federal investigators to provide a comprehensive look at any and all inappropriate spending. While the funding in question represents less than 1.5 percent of the organization’s overall budget, the JCCEO Board of Directors is deeply committed to rooting out any problems that have existed in JCCEO’s finances and ensuring that every dollar this organization administrates is used in the most efficient way to provide services that strengthen Jefferson County, Alabama and the children and families we serve.

JCCEO remains in sound operational and financial condition. Every year, an annual audit of the Agency’s financial statements is conducted by a reputable accounting firm with experience in accounting for federal funding. The audits have provided clean reports, and any occasional minor exceptions have been immediately addressed. Additionally, regular reviews by many of our granting authorities have consistently received positive feedback.

In March, we accepted Ms. Gayle Cunningham’s resignation, and in June, we announced that Dr. Marquita Davis had been hired as the new Executive Director of JCCEO. We are confident in Dr. Davis’ ability to lead this organization, and are looking forward to the continued growth of the Agency.

From Executive Director Dr. Marquita Davis:

The work we do at JCCEO – providing quality early learning experiences, helping to reduce homelessness, offering substance abuse counseling, training juvenile justice offenders for the workforce, and more – plays an integral role in the success of our community. The funding in question does not impact any of our existing programs. Our focus today is on re-enforcing stability within those programs and continuing to provide quality community services for low-income citizens of Jefferson County, Alabama.