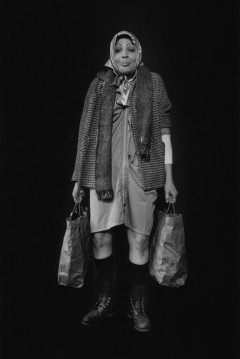

Study finds even wealthy women worry about

becoming ‘The best dressed Bag Lady in their community’

Study finds even wealthy women worry about

becoming ‘The best dressed Bag Lady in their community’

Nearly half of all American women, no matter their background, share a fear that may seem odd given the wealth of some: They are afraid of losing their financial independence, otherwise known as “Bag Lady Syndrome,” according to a 2013 study.

Of those who harbor BLS anxiety, 60 percent were the primary breadwinners for their households, according to the Allianz poll of 2,200 women ages 25 to 75.

“Financially, women’s needs are different from those of men, and the financial industry isn’t meeting them,” says Lance Drucker, CEO and president of the New York City-based Drucker Wealth Management, (www.DruckerWealth.com).

“Women typically live longer than men, so they need more retirement savings. Further compounding the problem is the fact that, in many cases, women are paid less for the same job as men. Finally, many have fewer earning years because they dropped out of the labor force for a time to have and raise their children.”

Drucker, author of “How to Avoid Bag Lady Syndrome (BLS): A Strong Woman’s Guide to Financial Peace of Mind,” offers seven action steps that women can do to address their financial insecurity:

• Identify your pain as well as your goals. Answer the following questions: What keeps me up at night? What worries me most about my money and my future? What do I want to do with the rest of my life? When can I afford to retire? Can I afford to stay retired? Can I travel, change careers, or go back to school?

• Create a budget that includes fixed and variable monthly costs as well as one-time expenses. Based on your budget, start building a cash cushion that will cover six to nine months of fixed expenses. The ultimate goal of retirement planning is to create an income stream that is sustainable and will support your retirement needs.

• Create a balance sheet of savings and investments. This includes your savings account, stocks, bonds, mutual funds, investment real estate, cash value life insurance, annuities, retirement accounts, individual retirement accounts, 401 (k) plans and other assets. Then further break it down by pre-tax and post tax-accounts.

• Review insurance coverage and needs. Are you supporting anyone else? Is there a need for Life Insurance? Who will take care of you if you get sick? Do you have Long Term Care Insurance? One mother can raise 10 kids, but 10 kids can’t take care of one mother… Younger and healthier women may be tempted to overlook the importance of this step, but failure to anticipate potential health issues can be very expensive.

• Address your estate-planning needs. Do you have a will, a durable power of attorney or a health care proxy? Have you updated your beneficiary designations on your retirement accounts? Does it make sense to put your assets in a trust to avoid probate? Answers for these questions are important.

• Develop your investment strategy. Is there a purpose to your current investment approach, or are you just accumulating funds? We recommend something we call a “4 Bucket Approach to Purposeful Investing” that has been designed with the help of a Wharton Business School professor.

• Hire a Coach. Studies have shown that those investors that utilize a high quality financial advisor feel more confident, optimistic, and significantly more likely to stick to their plan versus do-it-yourself investors.